personal property tax richmond va due date

Tax rates differ depending on where you. Prepayments are accepted if you would like to make payments in advance of the due date for real estate and personal property taxes.

Half of Real Estate Tax Due.

. Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond. Property Taxes are due once a year in Richmond on the first business day of July.

The second due date. Personal Property Taxes are due semi-annually on June 25th and December 5th. Under Virginia law the government of Richmond.

For all due dates if the date falls on a Saturday Sunday or County holiday the due date is extended to the following business day. Richmond residents will have until July 4 to pay their property taxes without penalty. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments.

WRIC The City of Richmond has extended the due date for personal. View important dates for current supplements and due. It is estimated that by freezing the rate the city will provide Richmonders more than 8.

Business Personal Property Taxes are billed once a year with a December 5 th due date. There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues. Jun 2 2022 1110 AM EDT.

WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. Business Personal Property Registration Form An ANNUAL filing is required on all business personal. Pay Personal Property Taxes in the City of Richmond Virginia using this service.

Business tangible personal property tax payment. Jun 2 2022 1110 AM EDT. Installment bills are due on or before June 5th and on or before.

Supplement bills are due within 30 days of the bill date. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Real Estate and Personal Property Prepayments.

Councilman Pushes For Tax Reform As Richmond Property Values Rise

Value Of Used Cars Impacting Personal Property Taxes Vpm

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news

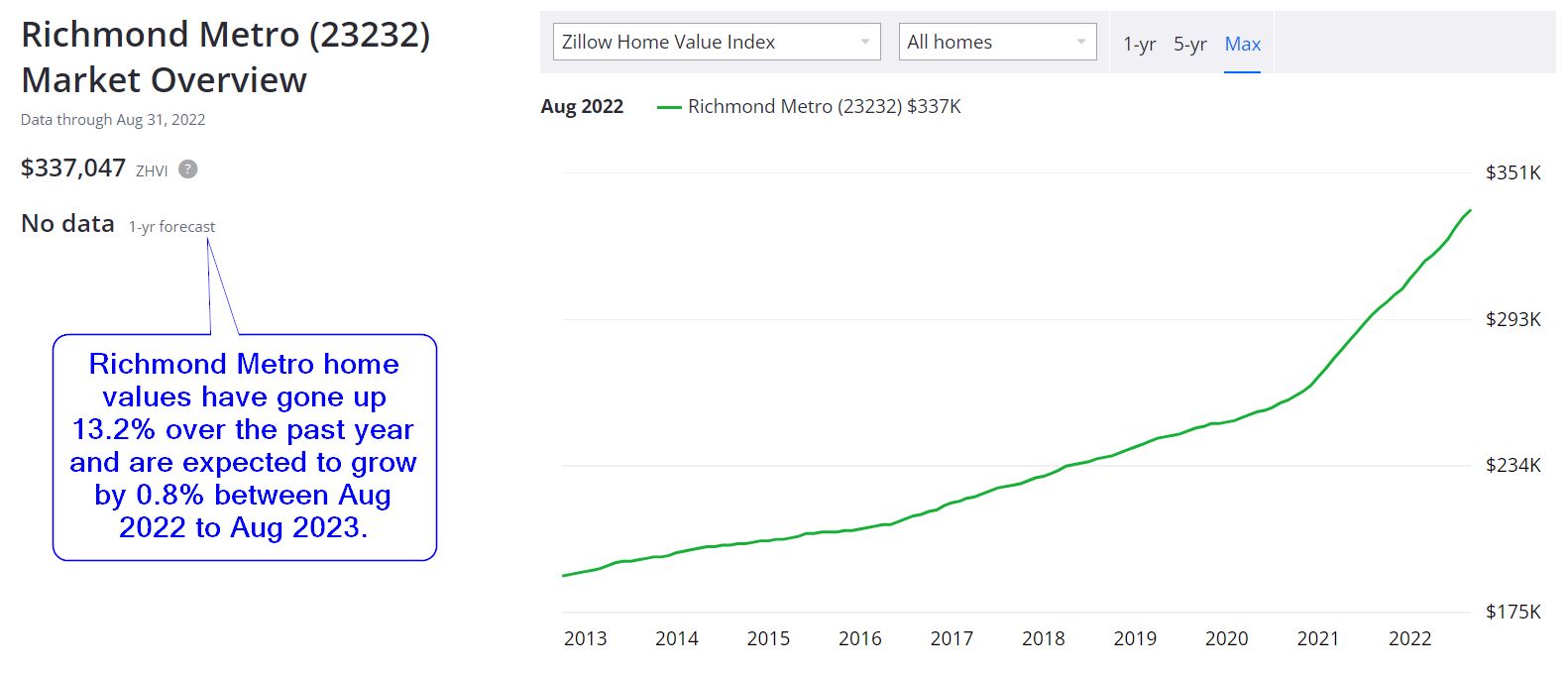

Richmond Va Housing Market Prices Trends Forecast 2022 2023

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Virginia Cities That Have Disappeared And Why

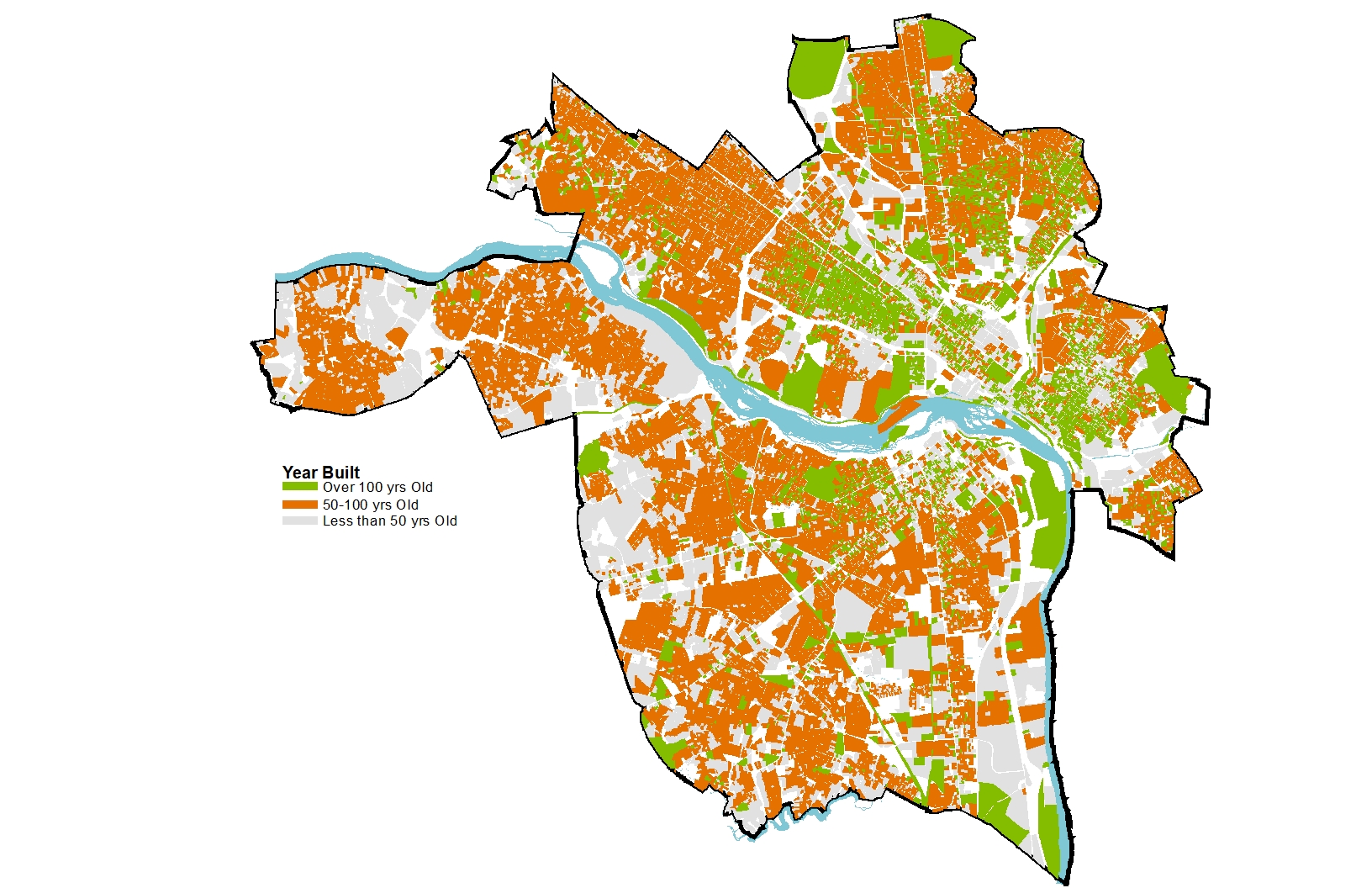

Historic Preservation Richmond

Richmond Property Tax 2022 Calculator Rates Wowa Ca

Virginia Tax Legislation 2022 General Assembly

Personal Property Tax Deadline For Goochland Residents Extended With Interest Payments Penalties Waived Wric Abc 8news

Virginia Taxation Familysearch

Raleigh County Assessor Serving All Of Raleigh County

University Of Richmond Wikipedia

/do0bihdskp9dy.cloudfront.net/10-31-2022/t_426a3c62a009452ba60e25b4cd068375_name_credit_report.jpg)